Table of Content

The State bank of India is offering an interest rate of 6.9% p.a. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. The SBI home loan calculator provides an option to compare multiple EMIs, which may vary because of different combinations of the loan amount, interest rate and tenures the borrower may log into the calculator. This allows the borrower to discover an EMI amount that aligns with their budget.

This makes the entire process of identifying and buying a house easier and more flexible. You won't be under pressure to identify a house as you know how much funds the bank would make available to you. Generally, banking & finance institutions pay around 75% to 85% of the cost of the property bought. The remaining 25% to 15% of the amount is paid on an up-front basis, which is popularly known as the down payment. EMI or Equated Monthly Instalment is a fixed amount paid by you to the bank on a specific date every month.

Benefits of SBI Home Loan EMI Calculator

Performance information may have changed since the time of publication. To get a rough idea of how much owning a home will cost, start by using a mortgage calculator to crunch the numbers. If you lock in today’s 5/1 ARM interest rate of 5.46% on a $100,000 loan, your monthly payments will be $565.

When you are looking out for a home loan, you will have to know about the SBI home loan interest rate in detail. The State Bank of India also has a consolidated processing fee for the loan amount, and it would also be subject to General Service Tax. While it is potentially bad news for mortgage borrowers, the base rate rise will once again be welcomed by savers. 'Some may consider lengthening the term when they remortgage to a higher fixed rate in order to mitigate the increase in the monthly payment and give a little additional breathing space,' says Hollingworth. While most borrowers prefer the certainty of fixed monthly payments, around a quarter of UK mortgages are on variable deals. Those already on a fixed rate mortgage will not immediately feel the effect of the rise, as they are locked into their existing rate until the term ends.

Latest SBI Home Loan News & Update

The maximum number of houses is three that could be bought with this scheme. The advantages of this scheme are lower interest rates for women and an O/D facility available. We levy interest based on daily reducing balance, unlike the annual reducing balance method used by several other financiers/banks. Interest paid on housing loans is allowed as a deduction to the extent of 2 lakh in respect of self-occupied property.

Your closing costs play a crucial role in determining your annual percentage rate . In other words, the higher your closing costs, the higher your APR will be.. Any time can be a good time to buy a home if you can afford the payment, and while buyers face high mortgage rates and prices, those both could improve in the near future. Today mortgage rates went in a mixture of directions, but we saw one important rate decrease.

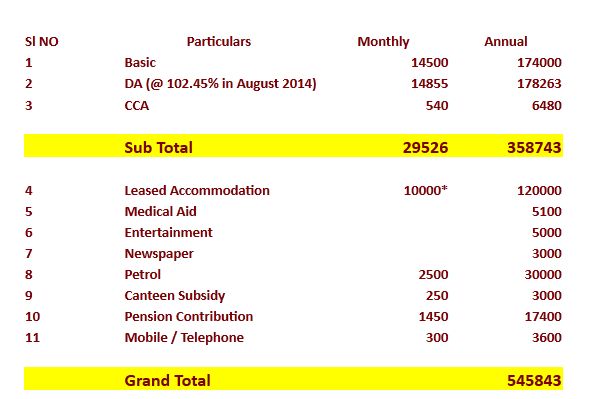

Home Loans Interest Rates (Current) - Interest Rates

If the buyer wants to take a loan to buy the property, the process is much easier if he/she approaches the same bank. In these cases, the bank does not need to release the property papers to another bank before getting the payment. On an average, loans are disbursed within 3-10 days after satisfactory and complete documentation and completion of all the required procedures. The borrower should be a resident of India or an NRIHe / she should be above 18years of age at the beginning of the loanRepayment should be up to the age of 70 years. Maxgain Home Loan is an innovative and customer-friendly product enabling the customers to earn optimal yield on their savings by reducing interest burden on Home Loans, with no extra cost.

“From a mortgage perspective, rates have actually gone down even though the Fed has raised rates. We think you’re going to see lower rates into the next year despite further rate hikes,” says JR Gondeck, partner and managing director with the Lerner Group, a financial advisory firm. They’re driven largely by inflation, and it appears price increases are slowing. The Consumer Price Index was 7.1% in November, better than expected for the second month in a row.

Home Loan EMI Calculator

We offer housing loans with low equated monthly instalments, i.e. you pay substantially less in repayments as compared to others. Similarly extended repayment period may be sanctioned provided that at all times the criteria regarding maximum permissible finance and security margin under the Bank's scheme are not diluted. Privilege Home Loans is an exclusive home loan product for government employees whereas Shaurya Home Loan is for Defense Personals. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs. This variant of SBI home loan is very useful for young salaried between years.

As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. Once all the above details are furnished, you can go ahead with the calculation. However, the loan amount is decided by the lender and is influenced by a lot of factors.

This time last year they were 2.34 per cent and 2.64 per cent respectively. This has been compounded by further mortgage rate hikes in the wake of September's disastrous mini-Budget. Some of the sharp rise in mortgage rates ha since been unwound, but they remain far higher than they were. As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more.

We'll ensure you're the very first to know the moment rates change. The SBI Home loan interest certificate is a statement of your home loan account which is given by SBI and is useful to know your loan status as well as for claiming tax benefits. It is advised that only the applicant or co-applicant for the SBI home loan visit the branch to obtain these particular papers. The applicant or co-applicant may send someone on their behalf, with a letter of authority and ID evidence for both that person and the applicant or co-applicant, if visiting the branch is not possible. Include any pertinent information, including the applicant’s date of birth, email address, and other contact information as appropriate, such as the home loan account number.

The use of the SBI Bank home loan EMI calculator makes this calculation easy. All one needs is the information of the principal loan amount, rate of interest, and loan tenure. But, this is the most ideal rate which is mostly offered to govt officials or individuals who are in top companies. For people who are working in a decent organization or running their own businesses, this SBI home loan interest rate can somewhere be around 7.90%. Under the festive offer, the bank is currently offering a concession from 15 bps to 30 bps in various home loan categories. These articles, the information therein and their other contents are for information purposes only.

You can calculate your home loan EMI almost instantly using the Home Loan Calculator. This calculator for Home Loan EMI might require just a few key home loan details from the user to display results. By using the SBI home loan EMI calculator SBI for 20 years, the EMI for Rs. 50 lakh loan for 20 years @ 7.90% p.a. Accurate Calculation – The use of the SBI home loan EMI calculator ensures accuracy.

How to Calculate SBI Housing Loan EMI Online

If the spouse is the co-owner of the property that is being bought with the loan, or is a guarantor of the loan, then the salary of the spouse is taken into account when determining the loan amount. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. SBI customers can visit the nearest branch and submit a written application, with the necessary details and collect the certificate in a short time.

No comments:

Post a Comment